海外研报

筛选

US Economics Weekly Risingunemployment is not“transitory'

CITI'S TAKEThe rise in the unemployment rate is the clearest sign yet that rather thanachieving a “soft landing" the US economy is more likely to slide intorecession.Attempts to explain away

海外研报

2024年08月14日

The Yen Carry Trade—A Roadblock to BoJ Hikes, Not Fed Cuts (Fishman/Kanter)

The recent sharp appreciation of the Yen coinciding with a spike in cross-assetvolatility has heightened the focus on the “Yen carry trade” and the broader

海外研报

2024年08月14日

How much does credit card delinquency matter for spending?

Beware clickbaitRecent releases of the New York Fed’s Quarterly Report on Household Debt and Credit

海外研报

2024年08月14日

Weekly Warm-up: Valuations Matter and Defensive Quality Is Still the Best Option

Markets are looking for better growth or more policy support to get excited again. We don't see confirming evidence in either

海外研报

2024年08月14日

G7 and BIC outlook

Although the labor market has cooled substantially, there is not enough evidence of recession in the near-term.

海外研报

2024年08月14日

TECHNICAL ANALYSIS

2y UST experienced a steep down move after break below multi-month ascending trend line and recently revisited May 2023 low of

海外研报

2024年08月14日

Gold to get its medal

The Fed’s cutting cycle, when it begins, will attract strategic investment in gold. We have lifted our year-end price target for gold to USD2,550/oz.

海外研报

2024年08月14日

Taking stock after the surge in market volatility

Deeper DiveMarkets have given investors a rollercoaster ride over the past week. Arisk-off move in markets gathered pace at the start of last week as an

海外研报

2024年08月14日

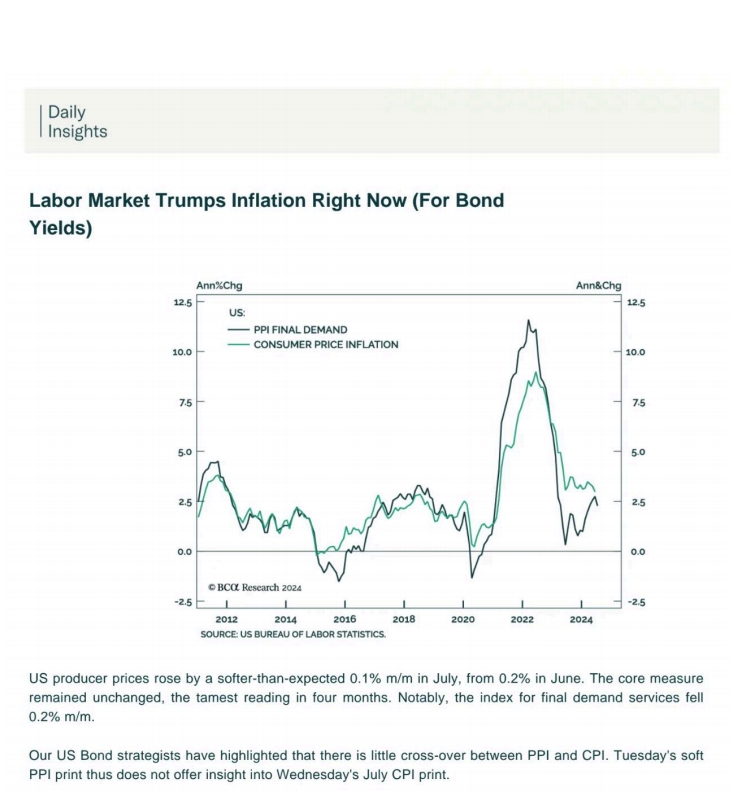

Labor Market Trumps inflation Right Now (For BondYields)

US producer prices rose by a softer-than-expected 0.1% m/m in July, from 0.2% in June. The core measureremained unchanged, the tamest reading in four months. Notably, the index for final demand services fel0.2% m/m.

海外研报

2024年08月15日