海外研报

筛选

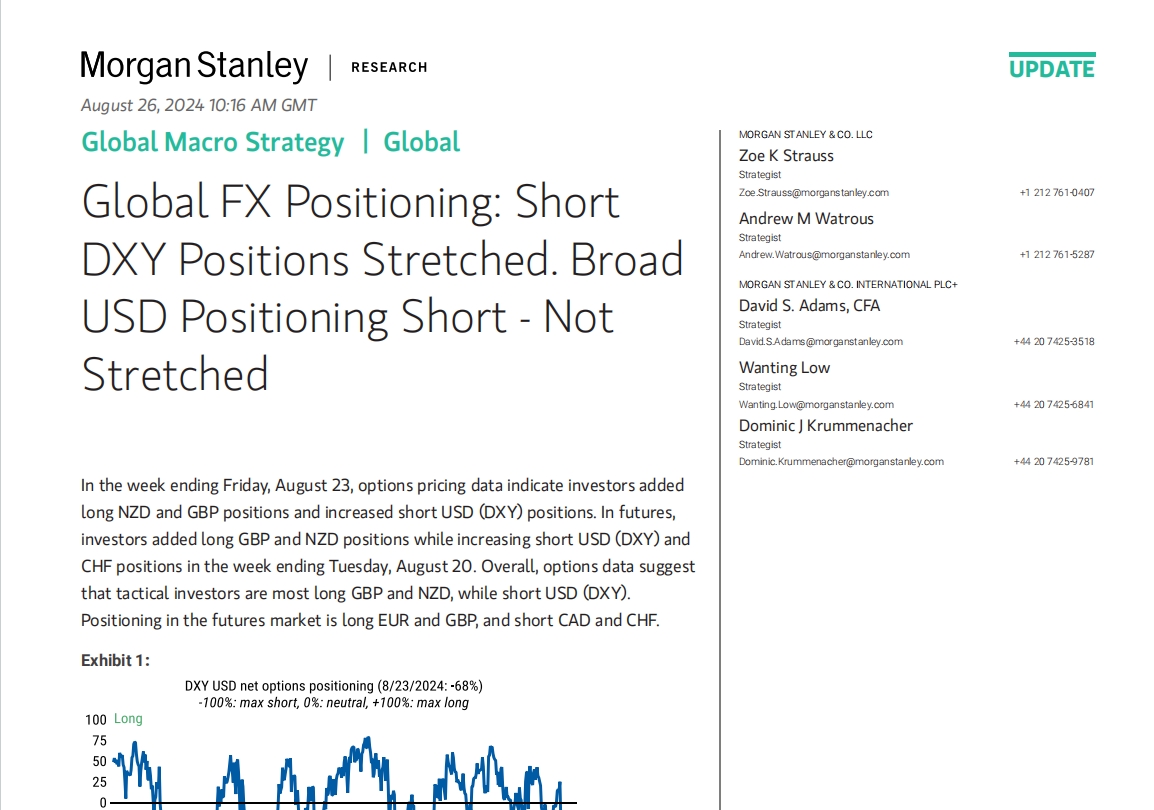

Global FX Positioning: Short DXY Positions Stretched. Broad USD Positioning Short - Not Stretched

In the week ending Friday, August 23, options pricing data indicate investors added long NZD and GBP positions and increased short USD (DXY) positions. In futures,

海外研报

2024年08月29日

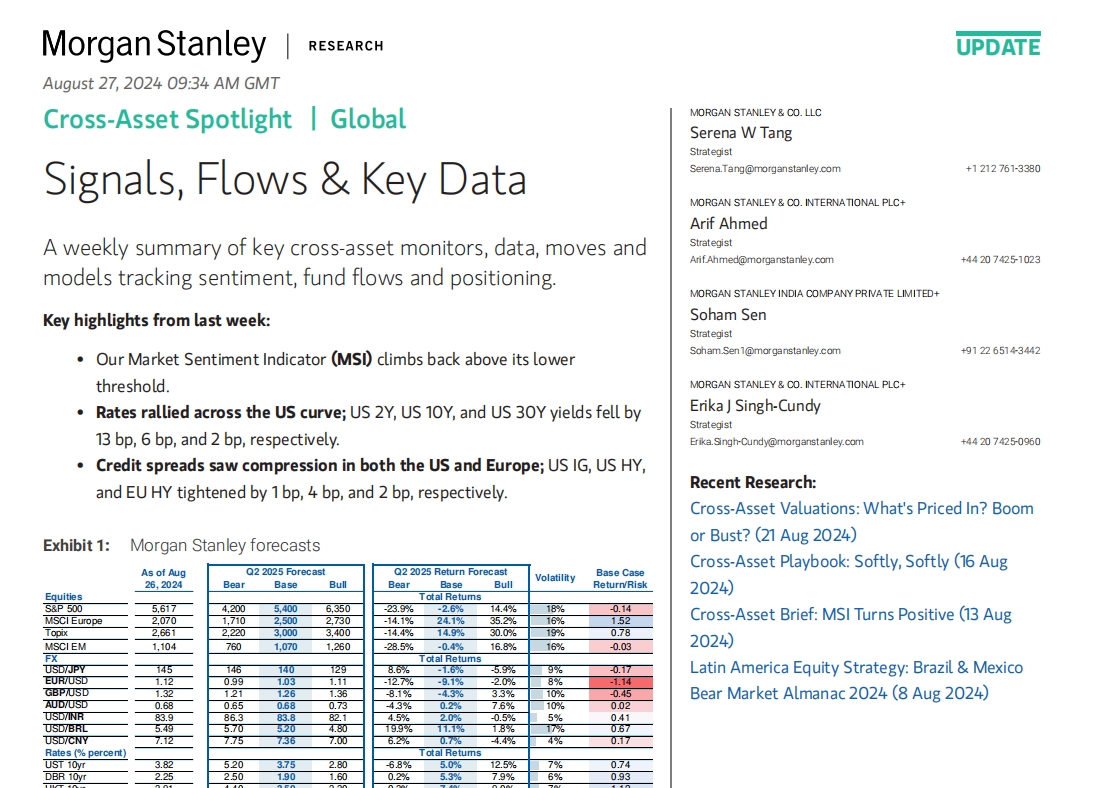

Signals, Flows & Key Data

A weekly summary of key cross-asset monitors, data, moves and models tracking sentiment, fund flows and positioning.

海外研报

2024年08月29日

THE EUROZONE ECONOMIC MONITOR

Destatis confirmed the decline in German GDP in Q2, despite still not publishing services data.

海外研报

2024年08月29日

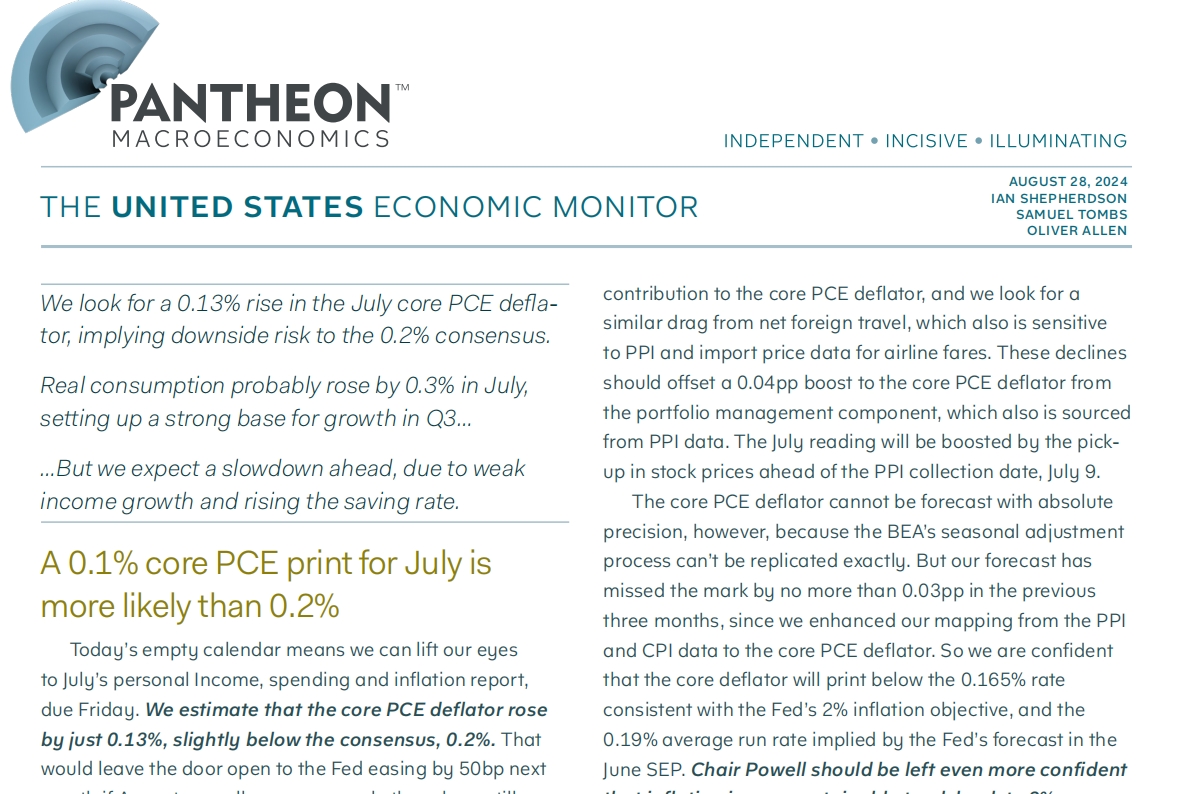

THE UNITED STATES ECONOMIC MONITOR

We look for a 0.13% rise in the July core PCE deflator, implying downside risk to the 0.2% consensus.Real consumption probably rose by 0.3% in July,

海外研报

2024年08月29日

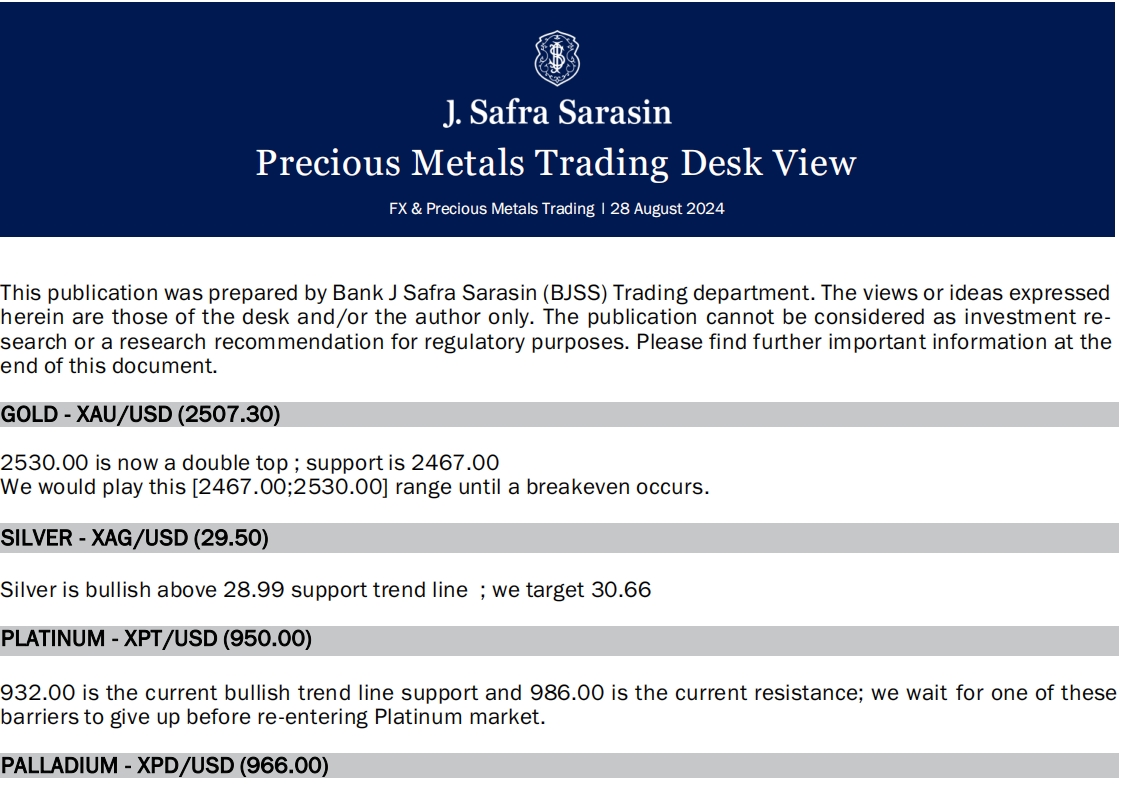

Precious Metals Trading Desk View

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk and/or the author only. The publication cannot be considered as investment research or a

海外研报

2024年08月29日

Salesforce Inc. (CRM): First Take on F2Q25 Results

Salesforce is indicated up 4% AH as F2Q25 with sub revenue +9% yoy (+10% inCC) vs FactSet consensus’ 8.4%, OM of 33.7% (vs expectations for 32%), cRPO

海外研报

2024年08月29日

Fixed Income Special European futures rollover outlook Sep-24/Dec-24

The last trading date for Eurex June futures is 6 September and delivery is on 10 September. The first delivery date for Gilt June futures is 2 September. The rollover will gradually start on 27

海外研报

2024年08月29日

"Wolf! Wolf! The wolf is chasing the sheep!"

Market pricing of end-2024 Fed Funds fell from 4.66% (67bp below the current level) before the July labour market data were released, to 3.85% just before the (stronger) ISM services data

海外研报

2024年08月29日

TECHNICAL ANALYSIS

2y UST down move stalled after defending the May 2023 trough near 3.65% but signals of significant upside are not yet visible. 2y

海外研报

2024年08月29日

If the plan is to sell dollar rallies, it isn’t working.

Jay Powell’s focus on labour market data as the biggest driver of rate-hike timing leaves days like today (no jobs numbers, only consumer confidence, house prices and regional fed activity

海外研报

2024年08月29日