海外研报

筛选

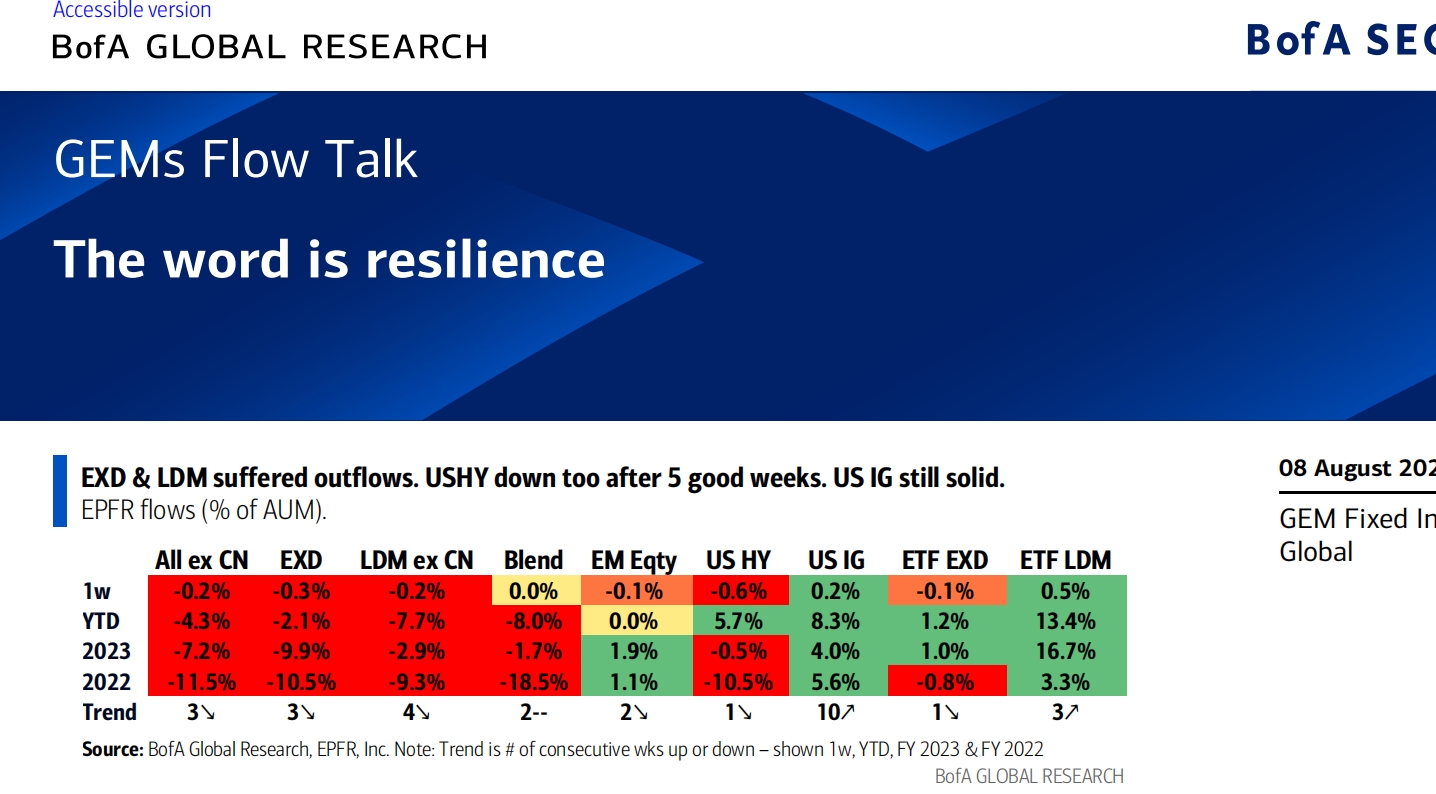

GEMs Flow Talk The word is resilience

Leverage: Credit markets held in well and support our view that there is little if any leverage in public credit markets. EM and DM spreads held in surprisingly well and

海外研报

2024年08月10日

SALES COMMENTARY ONLY (NOT A PRODUCT OF RESEARCH)

What a week – not only in markets but also in sports. With the Summer Olympics set to conclude on Sunday, it’s been nothing short of

海外研报

2024年08月14日

European Contextual Diary The Week Ahead

In this note we preview the coming week's corporate events Below we highlight three key events for next week. Please see this excel for a full list of

海外研报

2024年08月18日

OLYMPIC MEDALS AS A LEADING INDICATOR?

With the Paris Olympics having finished with a medal table reminiscent of Cold War superpower dominance, we decided to take a look at the historical medal performance at the Summer Games

海外研报

2024年08月22日

Time to Enter UST Steepeners

After having adopted a neutral stance on the US yield curve for much of the past year, we believe now is the time to enter US

海外研报

2024年08月26日

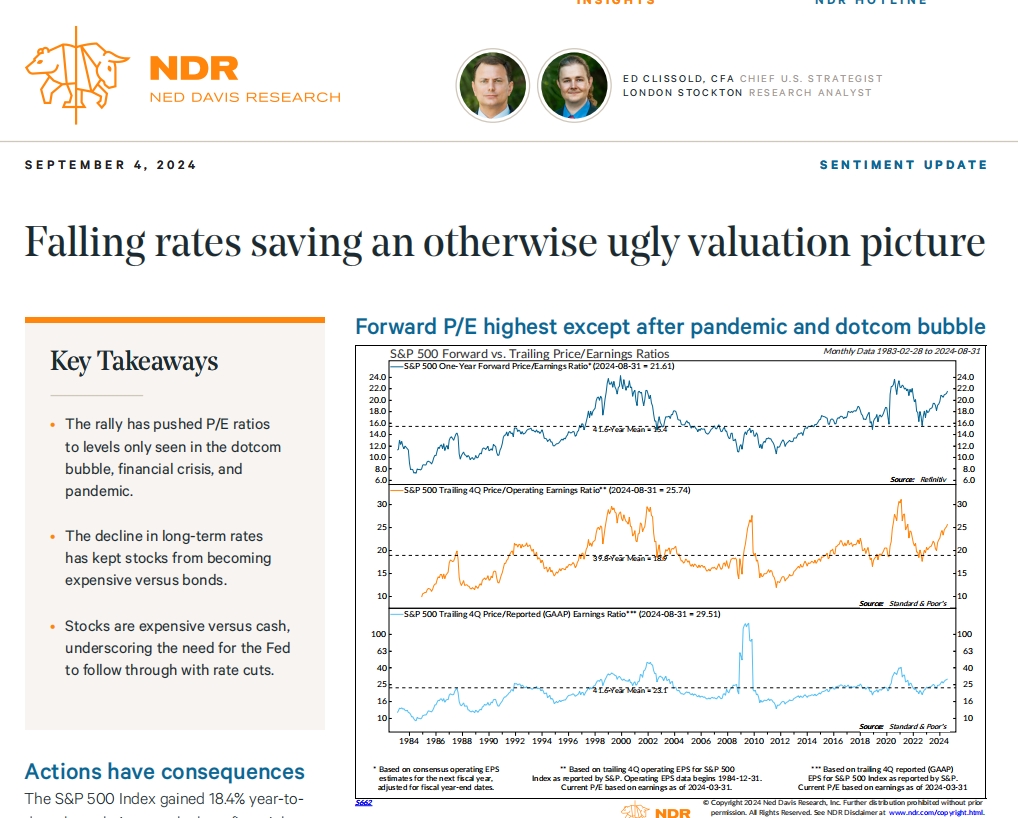

Falling rates saving an otherwise ugly valuation picture

Actions have consequencesThe S&P 500 Index gained 18.4% year-todate through August, the best first eight months of the year since 2021, the secondbest this century, and the 12th best since

海外研报

2024年09月05日

GS--China Consumer Staples: Expert call takeaways

On Sept 3, we hosted a virtual conference with a large-scale Spirits and F&Bdistributor located in Hunan province. Key highlights include: 1) Spirits: The

海外研报

2024年09月10日

The week ahead: Fed not going big (yet)

• A Fed rate cut next week seems to be a done deal.The crucial question for investors has been whether

海外研报

2024年09月13日

JPM - trading the easing cycle

A typical rate cutting cycle is not always positive though in each of the last 5 cutting cycles, we have seen the SPX higher on a 1M, 3M, 6M, and 12M basis. Is that the expectation for this cycle? Yes, as we think

海外研报

2024年09月19日