海外研报

筛选

Tech Positioning, Tech Calls, Networking Previews (COHR, FN, LITE), FTNT, WBD, Quanta

My colleague Jack Atherton, who covers Comm, Internet, Media and Sofware, is on New Parent Leave untilLabor Day, !'l be backing him up - including sending this combined TMT morning daily, and providing hisearnings first-takes in the weeks to

海外研报

2024年08月14日

UMichigan Sentiment Above Expectations and Inflation Expectations Unchanged

BOTTOM LINE: The University of Michigan’s index of consumer sentimentincreased in the August preliminary report, slightly above consensus expectations

海外研报

2024年08月18日

Boeing Co. (BA): Monthly aircraft delivery tracker: August mid-point check-in

Our aircraft delivery tracker, based on Planespotters data, shows Boeing hasdelivered 24 aircraft thus far in August through 8/21, including 16 737 MAX, 2 777, 3

海外研报

2024年08月22日

What's Priced In? Boom or Bust?

We analyze where cross-asset valuations are after the sell-off and rebound. While a shallow cutting cycle supports risk, we

海外研报

2024年08月26日

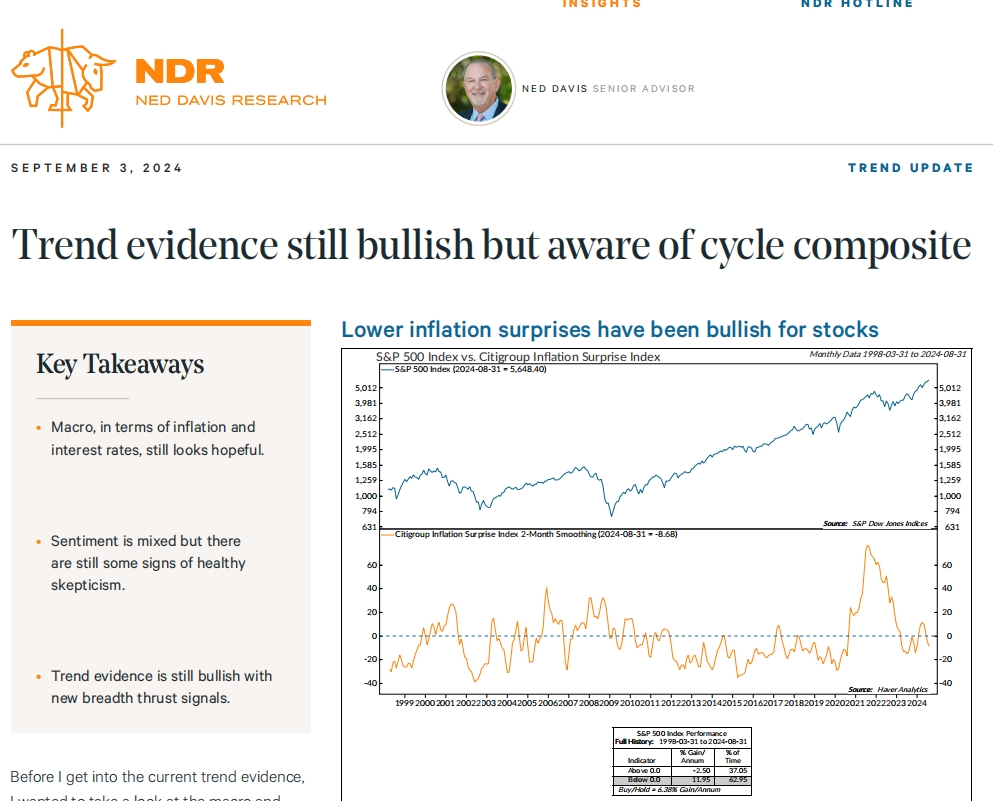

Trend evidence still bullish but aware of cycle composite

Before I get into the current trend evidence, I wanted to take a look at the macro and

海外研报

2024年09月05日

CT--Global Economics Global Indicators August Chartbook: The World in Pictures

CITI'S TAKE Our global indicators chartbook shows ongoing resilience in services

海外研报

2024年09月10日

GS--Global Views: Controlled Descent

1. While Friday’s US jobs report fell modestly short of expectations, it showed arebound from last month, with a 142k increase in nonfarm payrolls and a small dip in

海外研报

2024年09月13日

JPM_International Market Intell Morning Briefing_20240918

OVERNIGHT BRIEFEU/US trade: European Equities advanced after US retail sales (SXXP 0.4%, $X5E 0.7%) withCyclicals beating Defensives (0.8%, 1.1z). There was an element of short covering in the tapewith Most Short (2.3%, 2z) higher since the morning

海外研报

2024年09月19日

BofA_Systematic Flows Monitor Long bonds & Gold along with short USD & commods driving

CTA equity longs are higher but still with room to addSince we noted four weeks ago that differences in long- and short-term trend signals

海外研报

2024年09月23日

GS--Asia Views: The Fed opens the door, and the PBOC walks through

1. The People’s Bank of China announced a combination of monetary easingsteps this week. These included: a 20bp repo rate cut and a 50bp RRR cut (double

海外研报

2024年09月27日