海外研报

筛选

How Weak Is the Consumer?

Over the past few months, our discussions with clients have centered on the slowdown in consumer spending and the leading indicators which suggest it may

海外研报

2024年08月05日

WBD & PARA Credit: Another 'Spin' on Our Cautious Views

Sizable spread moves since mid-July, first idiosyncratic and then more market-driven, warrant a refresh of our views and trades.

海外研报

2024年08月05日

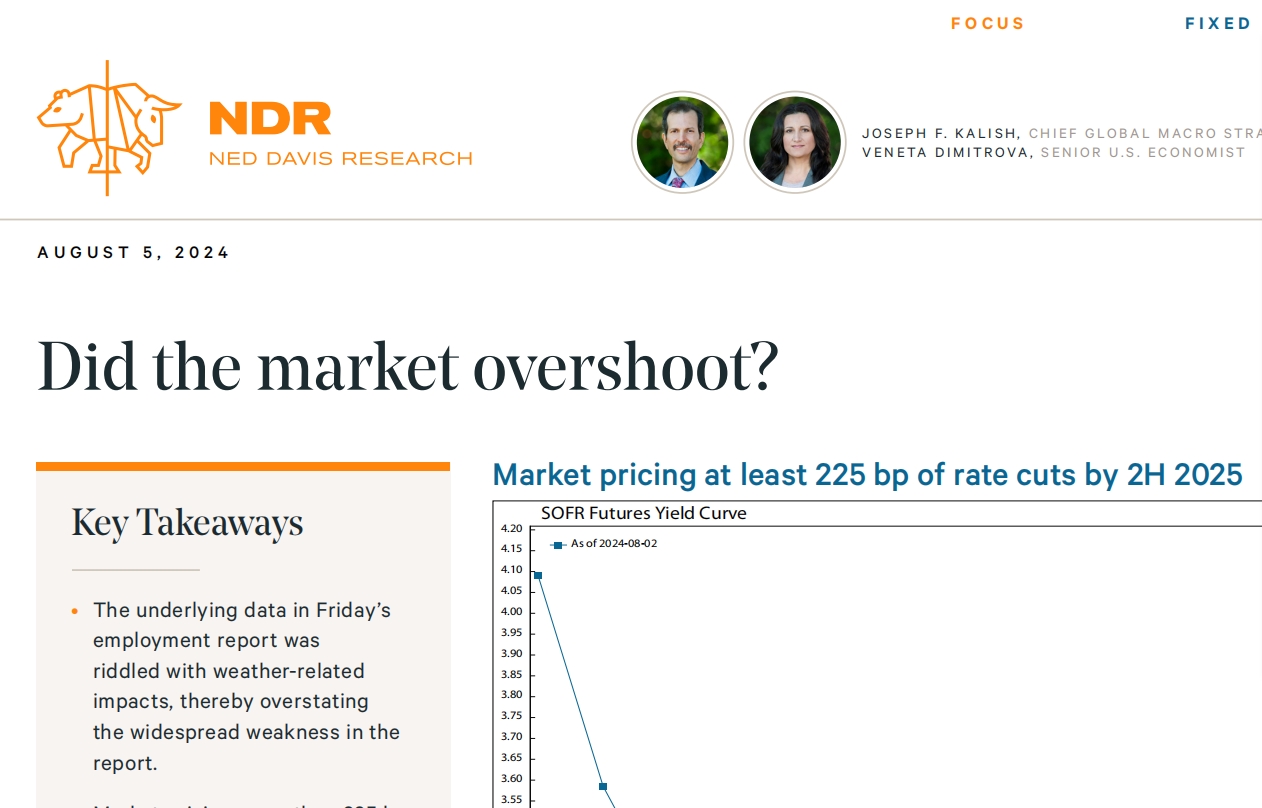

The Fed Dot Plod

Suddenly everyone is raising the number of Fed cuts this year and early next year. Without a doubt Friday’s job report was Weak with Few Redeeming Qualities. While we argued that the Fed SHOULD

海外研报

2024年08月05日

Trade Close: Close Options Recommendation

We close our recommendation to buy SO calls. We close our 31-July, 2024recommendation to buy SO 9-Aug Weekly $84 calls at a gain following their

海外研报

2024年08月05日

UK Weekly Kickstart Summer data-only update

MSCI disclosureAll MSCI data used in this report is the exclusive property of MSCI, Inc. (MSCI). Without prior written permission of MSCI,

海外研报

2024年08月05日

The US consumer today vs. tomorrow through the lens of micro company and macroeconomic datapoints

The July jobs report showed a larger-than-expected deterioration in the US labor market. Investor concerns over the health of the US consumer have

海外研报

2024年08月05日

Weak jobs report could put 50bp cut on the table

The July employment report was a weak one across the board, with downside surprises in just about every key metric. If there were any

海外研报

2024年08月05日

U.S. Desk Strategy Macro2Markets Outlook

As the dust settles post one of the most active macro weeks of the summer, the broader market is at the mercy of lower summer liquidity amid ongoing

海外研报

2024年08月06日

Hong Kong: PMI rose in July

The S&P Global Hong Kong PMI (which covers the manufacturing, construction,wholesale, retail and services sectors) rose to 49.5 in July from 48.2 in June. Among

海外研报

2024年08月06日