海外研报

筛选

CARRY TRADE HARD LANDING?

Japan’s balance sheet is hugely distorted by the years of excess accommodation. It was always a toss-up as to which fragility was going to break first – maturity or currency mismatch. In the end,

海外研报

2024年08月06日

BOJ, FED, FUEL SURGE IN EM FX VOLATILITY

Fed and BoJ meetings have further raised EM FX volatility. Last week’s FOMC meeting was widely interpreted as confirming the market expectation that the funds rate will be cut in

海外研报

2024年08月06日

Downgrade Retail to Neutral: 2Q24 Promos Suggest Weakening Demand

We downgrade Retail to Neutral from Positive on erosion ofinventory margin recapture as promos intensify and demand

海外研报

2024年08月08日

Global Markets Daily: US HY Is an Imperfect Election Instrument (Rogers)

While the ongoing market correction has taken center stage in recent sessions,the policy implications of the US elections remain a key topic among investors.

海外研报

2024年08月08日

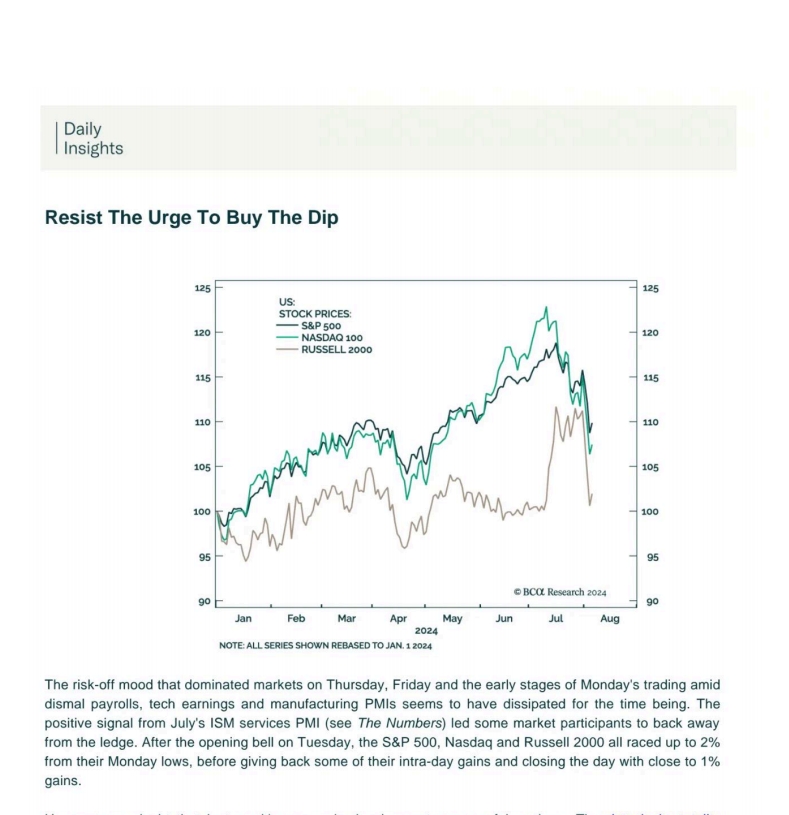

Resist The Urge To Buy The Dip

The risk-off mood that dominated markets on Thursday, Friday and the early stages of Monday's trading amiddismal payrolls, tech earnings and manufacturing PMls seems to have dissipated for the time being. Thepositive signal from July's iSM services

海外研报

2024年08月12日

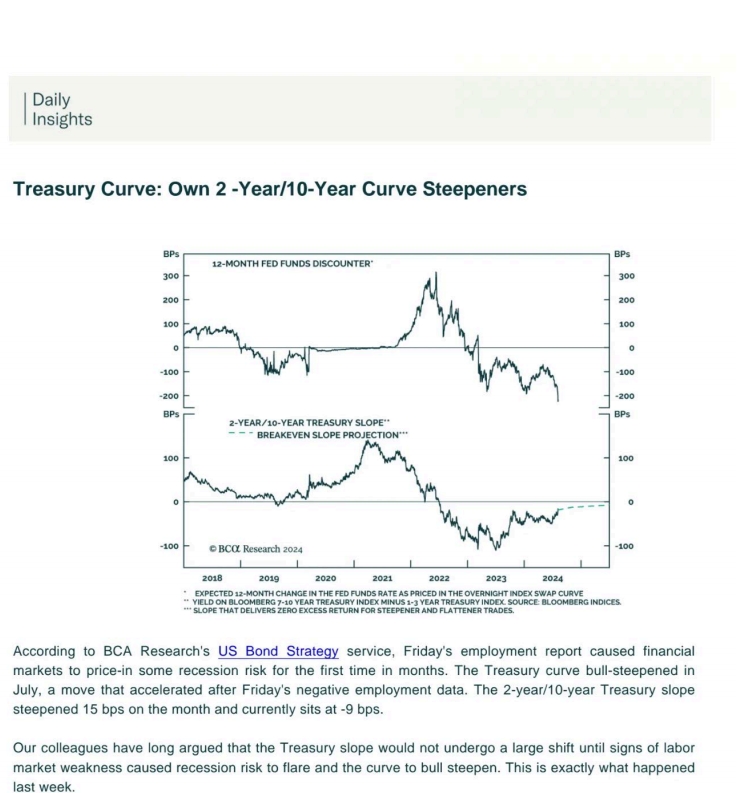

Treasury Curve: Own 2 -Year/10-Year Curve Steepeners

According to BCA Research's US Bond Strategy service, Friday's employment report caused financiamarkets to price-in some .

海外研报

2024年08月12日

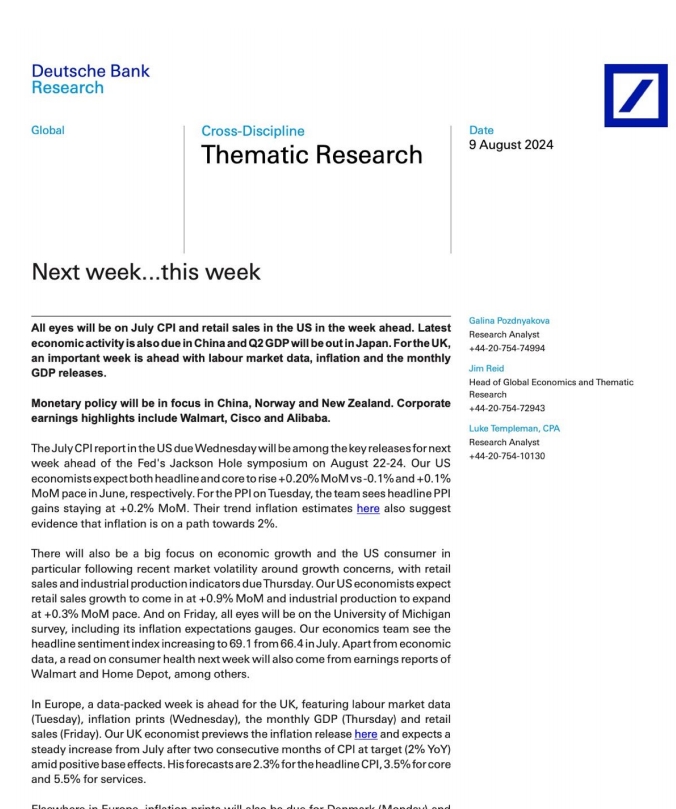

Next week...this week

The JulyCPl reportin theUSdueWednesdaywillbe amongthekeyreleasesfornextweek ahead of the Fed's Jackson Hole symposium on August 22-24. Our USeconomistsexpectboth headlineandcore torise +0.20%MoMvs-0.1%and +0.1%MoM pace

海外研报

2024年08月12日

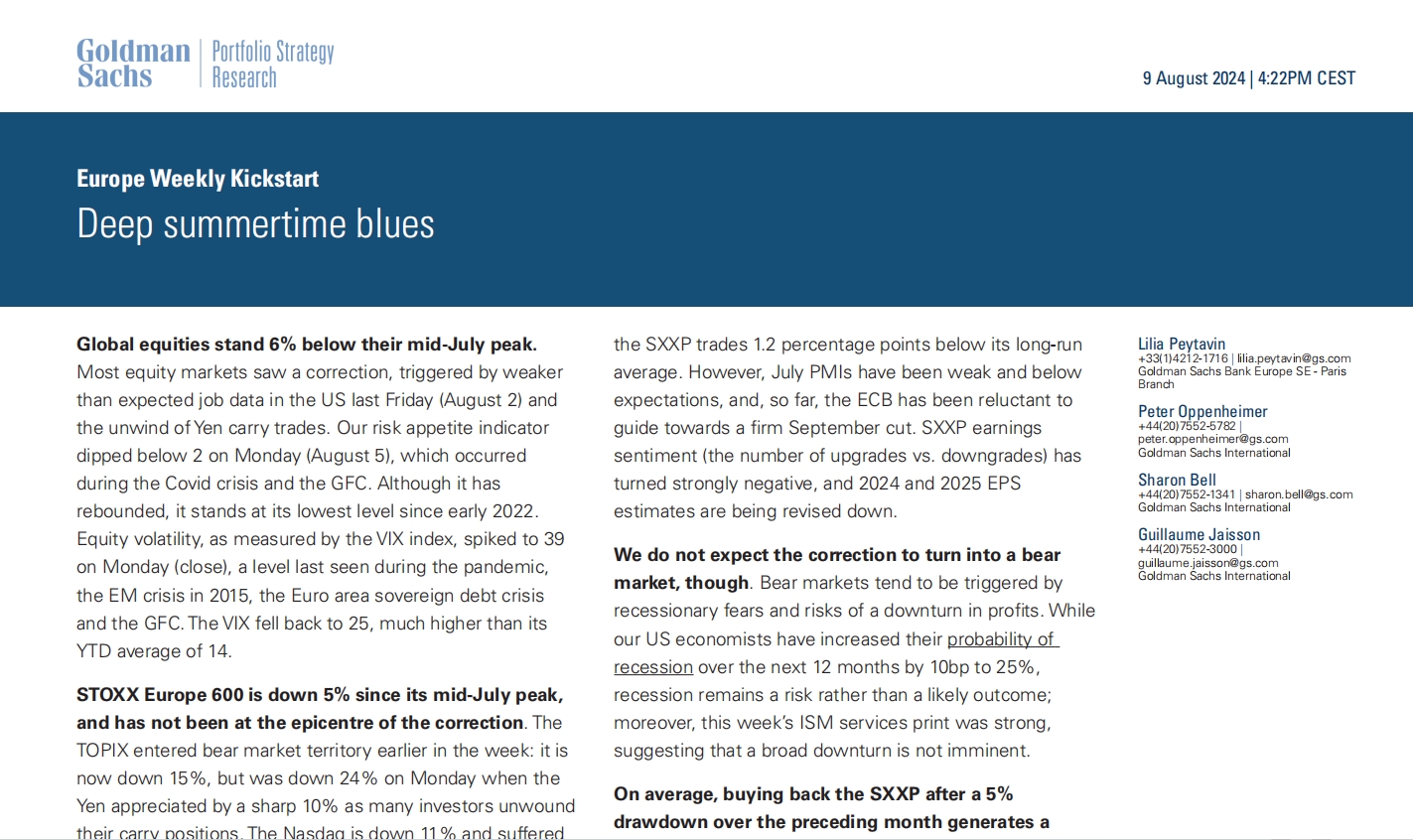

Europe Weekly Kickstart Deep summertime blues

Global equities stand 6% below their mid-July peak.Most equity markets saw a correction, triggered by weaker

海外研报

2024年08月12日

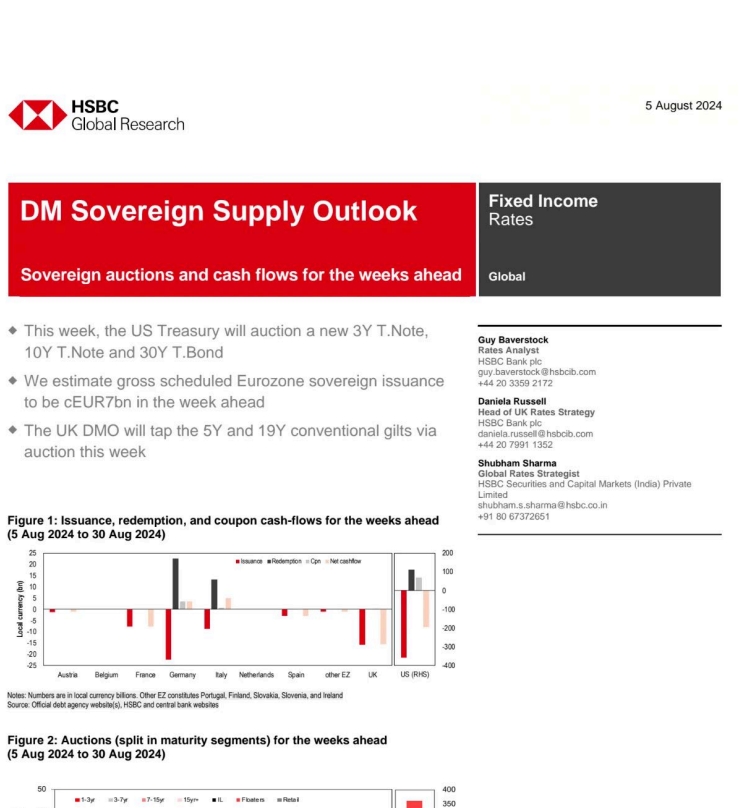

DM Sovereign Supply Outlook

This week, the US Treasury will auction a new 3Y T.Note.10Y T.Note and 30Y T.Bond

海外研报

2024年08月12日

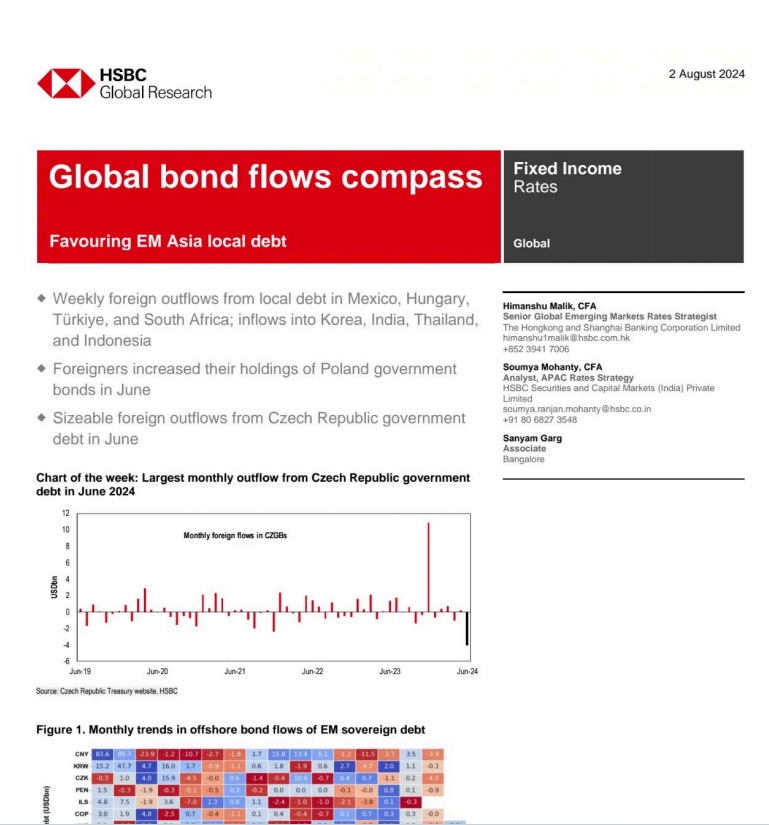

Global bond flows compass

Weekly foreign outflows from local debt in Mexico, HungaryT¼rkiye, and South Africa; inflows into Korea, India, Thailan?and

海外研报

2024年08月12日