海外研报

筛选

Viewpoint On The Cutting Room Floor

As the Federal Reserve (Fed) begins the first easing cycle in four years, our base

海外研报

2024年10月11日

US Daily: June CPI Preview (Hill/Walker)

We expect a 0.21% increase in June core CPI (vs. 0.2% consensus),corresponding to a year-over-year rate of 3.43% (vs. 3.4% consensus). We

海外研报

2024年07月11日

GS--TOPIX down -1.0% wow as yen strengthens; FX and Japanese equities

Summary of the weekTOPIX: 2,571.14 (-1.0%) / NK225: 36,581.76 (0.5%)n Top sectors: Air Transport, Electrical Machinery

海外研报

2024年09月16日

US MARKET INTELLIGENCE:MACRO WEEK AHEAD

SEP 16- Empire Mig at 8-30am ET.SEP 17 - Retail Sales and NY Fed Services Business Activity at 8:30am ET.

海外研报

2024年09月16日

UBS_WA (30)

In this note we preview the coming week's corporate events Below we highlight three key events for next week. Please see this excel for a full list of

海外研报

2024年09月16日

GS--GS TWIG Notes: This Week in Global Research - September 20, 2024

Fed functionality: cut rates, buy stocks… as long as growth is goodn David Mericle and team now see a faster path for the Fed to cut rates down to

海外研报

2024年09月22日

GS--EM Equity Strategy: Mutual Fund Positioning

With recent market volatility, positioning is at the forefront of investors’ minds. Inthis report, we focus on fund flow trends and investor positioning in EM and Asia,

海外研报

2024年09月09日

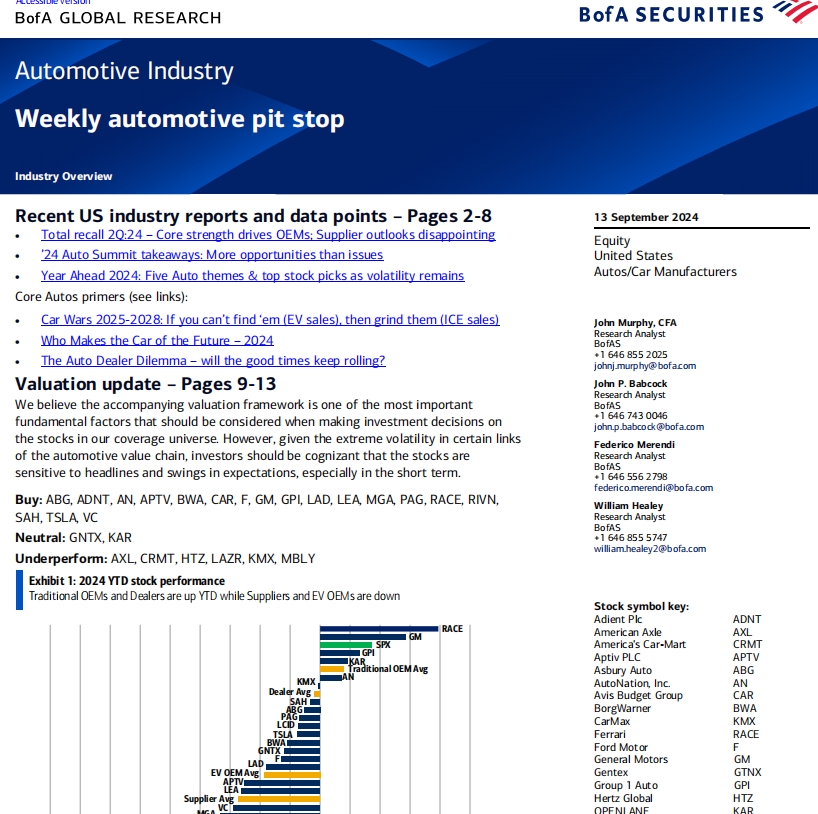

BofA--Automotive Industry Weekly automotive pit stop_20240913

Recent US industry reports and data points – Pages 2-8 • Total recall 2Q:24 – Core strength drives OEMs; Supplier outlooks disappointing•

海外研报

2024年09月15日

SocGen - Multi Asset Portfolio - Cracks in US exceptionalism

Societe Generale (“SG”) does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that SG may

海外研报

2024年09月16日

GS--Affirm Holdings (AFRM): Communacopia + Technology Conference — Key Takeaways

Moderated by: Will Nance, Payments and Financial Technology, Goldman SachsBottom Line: Overall, mgmt remained confident in the runway ahead of them, with

海外研报

2024年09月17日