海外研报

筛选

Correction dissection - US growth concerns and carry trade unwinds drive sharp

Following the large equity drawdowns and sharp ‘risk off’ shifts across assetsglobally in the past few days, we publish a short cross-asset update. We

海外研报

2024年08月07日

HOW INVESTABLE IS EUROPE?

Just as Europe emerged from two years of stagnation, weak survey data, increased political risk, and structural issues have put the region’s outlook back in question. So,

海外研报

2024年08月07日

Ratings and Target Price Changes - August 6, 2024 as of 5:30 AM ET

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result,

海外研报

2024年08月07日

10y JGB auction preview: A highly volatile climate

POTENTIAL POSITIVES・ BOJ's 31 July announcement has reduced uncertainty about JGB purchase taperingThe BOJ's "detailed plan" for tapering back its JGB absorption was basically in line with the

海外研报

2024年08月07日

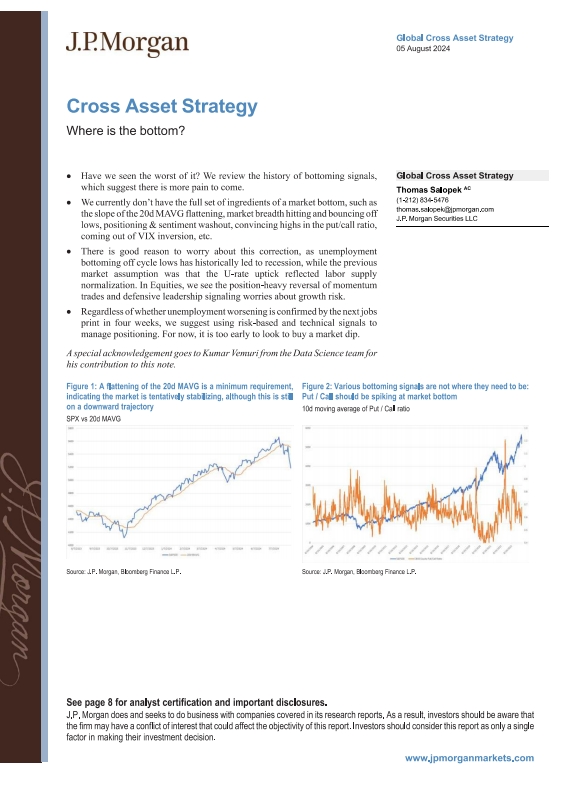

Cross Asset StrategyWhere is the bottom?

Have we seen the worst of it? We rewiew the history of bottaming signals,which suggest there is rnore pain to come.

海外研报

2024年08月07日

Beddriz Artuines arbeamiz annesd.pencom.PVorgan Chase Bank k.h, London Branch

A wli mde yoslerne a noll owor andMMEJMWALOJSD M prICUabouncing 2 5%6 aN heh I WAI GT! LHAE D MnceamBmE-fWBEN955l gan aiy support tom whal mas al eicourag ng U$ $eroes

海外研报

2024年08月07日

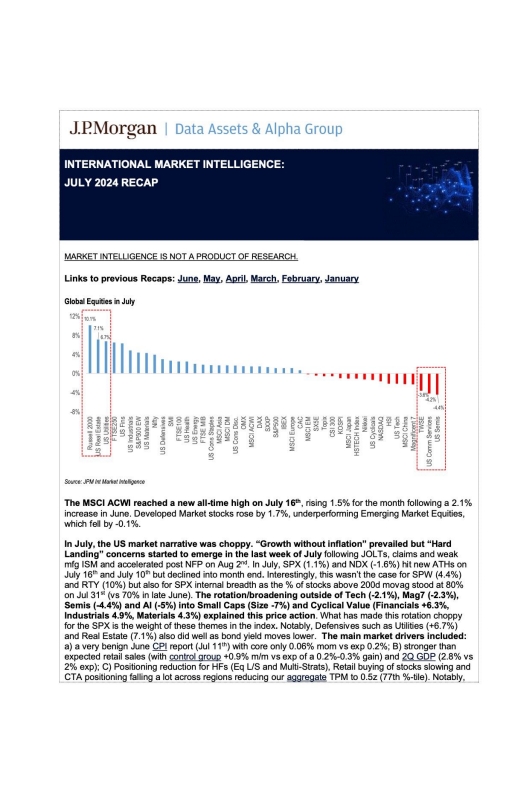

INTERNATIONAL MARKET INTELLIGENCE: JULY 2024 RECAP

In July, the US market narrative was choppy. “Growth without inflatlon" prevailed but "HardLanding" concerns started to emerge in the last week of Jjuly following JOLTs, ciaims and

海外研报

2024年08月07日

Nomura Quant Insights

US equities: CTAs and volatility control funds behind the curve in getting outThe latest (and much-watched) US jobs report brought a disappointment. The announced

海外研报

2024年08月07日

USD/JPY: We lower our near-term forecast

cut rates substantially / Will Japanese investors accelerate JPY appreciation?USD/JPY corrected to the 142-143 range for a while today, apparently reflecting the

海外研报

2024年08月07日

Precious Metals Trading Desk View

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed

海外研报

2024年08月07日