海外研报

筛选

Yen vs the World: Don’t get carried away

Nearly all Governor Ueda’s monetary policy press conferences has been on the dovish side. However, this

海外研报

2024年08月16日

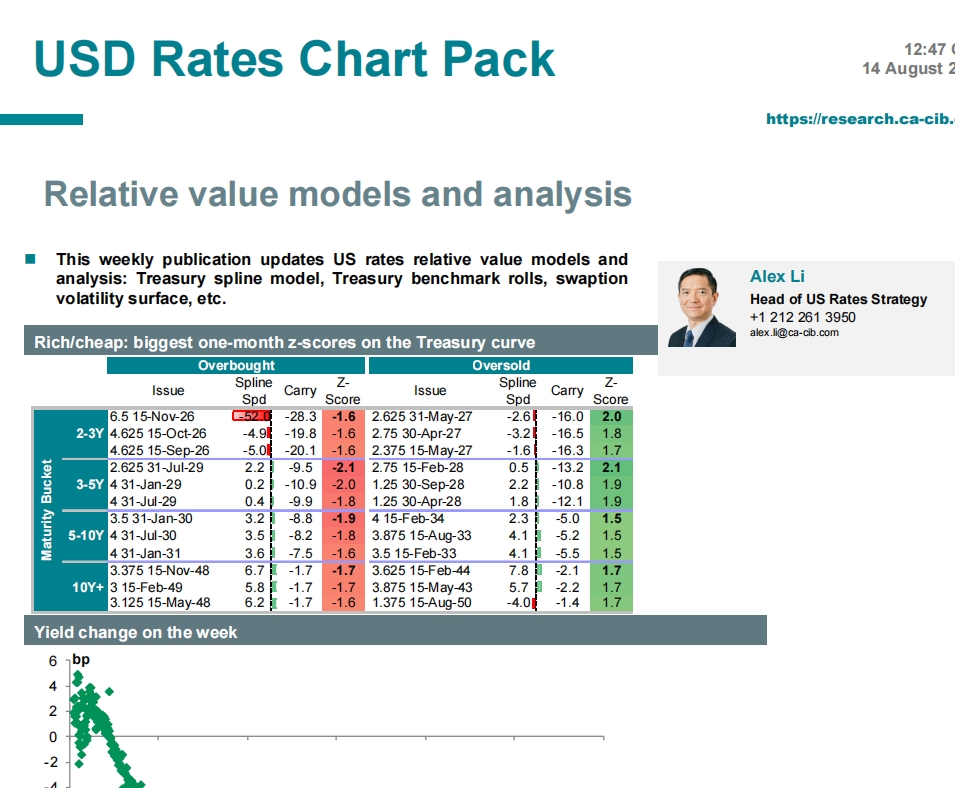

Relative value models and analysis

This weekly publication updates US rates relative value models and analysis: Treasury spline model, Treasury benchmark rolls, swaption

海外研报

2024年08月16日

AS IF NOTHING EVER HAPPENED?

MULTI ASSET Vol spikes like the one earlier this month are not uncommon. Historically, markets tend

海外研报

2024年08月18日

Employment growth can turn quickly

Employment rose a strong 58.2k in July after a 52.3k increase in June. Over the past six months employment growth has averaged 50.9k. That strength in

海外研报

2024年08月18日

June Q largely in-line with expectations; Taobao Tmall set for CMR reacceleration

Taobao Tmall online GMV grew high-single-digit % YoYFY1Q25 results came in mixed with revs slightly below Street expectations, including

海外研报

2024年08月18日

Global Economic Outlook & Strategy

CITI'S TAKEThe global economy looks likely to register annual growth of 2.4% in 2024only a modest slowdown from last year's pace as Hi data have broadlysurprised to the upside.in recent weeks, however,

海外研报

2024年08月18日

MXAPJ rebounded 3% as Asian markets generally rallied amid easing US

MXAPJ gained 2.7%, with significant gains in Korea,Singapore, Taiwan, and Philippines (+4-5%), while Thailand,

海外研报

2024年08月19日

Trend follower bond longs getting stretched, equity closer to neutral for now

CTAs likely not participating in equity rally (yet)The S&P 500 broke a four-week losing streak by posting its best weekly return since

海外研报

2024年08月19日

The RIC Report Top ten FAQs and some bullish views

Don’t let market noise & politics distract from the shift from a 2% world to a 5% world. Own value in equities, prudent yield in fixed income, and commodities. As we prepare for

海外研报

2024年08月19日

Catalysts and What Type of Landing?

Inflation seems to be under control (by recent standards), which helped markets. We were a bit surprised how strongly the market reacted to PPI, as it is generally a tier 2 piece of data, and we seem

海外研报

2024年08月19日