海外研报

筛选

Global FX Trader Rates Exaggerate

Our thoughts on USD, CHF, BRL, IDR, AUD/NZD, THB & Jackson Holen USD: Markets or macro. Investors have been asking whether the wild swings

海外研报

2024年08月19日

Healthcare Pulse: The Backdrop Into August’s Dog Days...

n Alongside all the macro ping-pong of the last severalweeks, the performance trajectory of the HC sector can

海外研报

2024年08月19日

Retail Sales: Just Keep Spending

Retail sales in July well exceeded expectations. The beat in retail sales was broad-based and showed that consumption remains solid,

海外研报

2024年08月19日

A truer signal from the unemployment rate

Historically, a substantial rise in the unemployment rate has been associated with a recession. But changes in the unemployment rate can be amplified or damped by

海外研报

2024年08月19日

US Week Ahead: August 19 - August 25

The key economic data releases this week are the jobless claims and existing homesales reports on Thursday. The minutes from the July FOMC meeting will be

海外研报

2024年08月19日

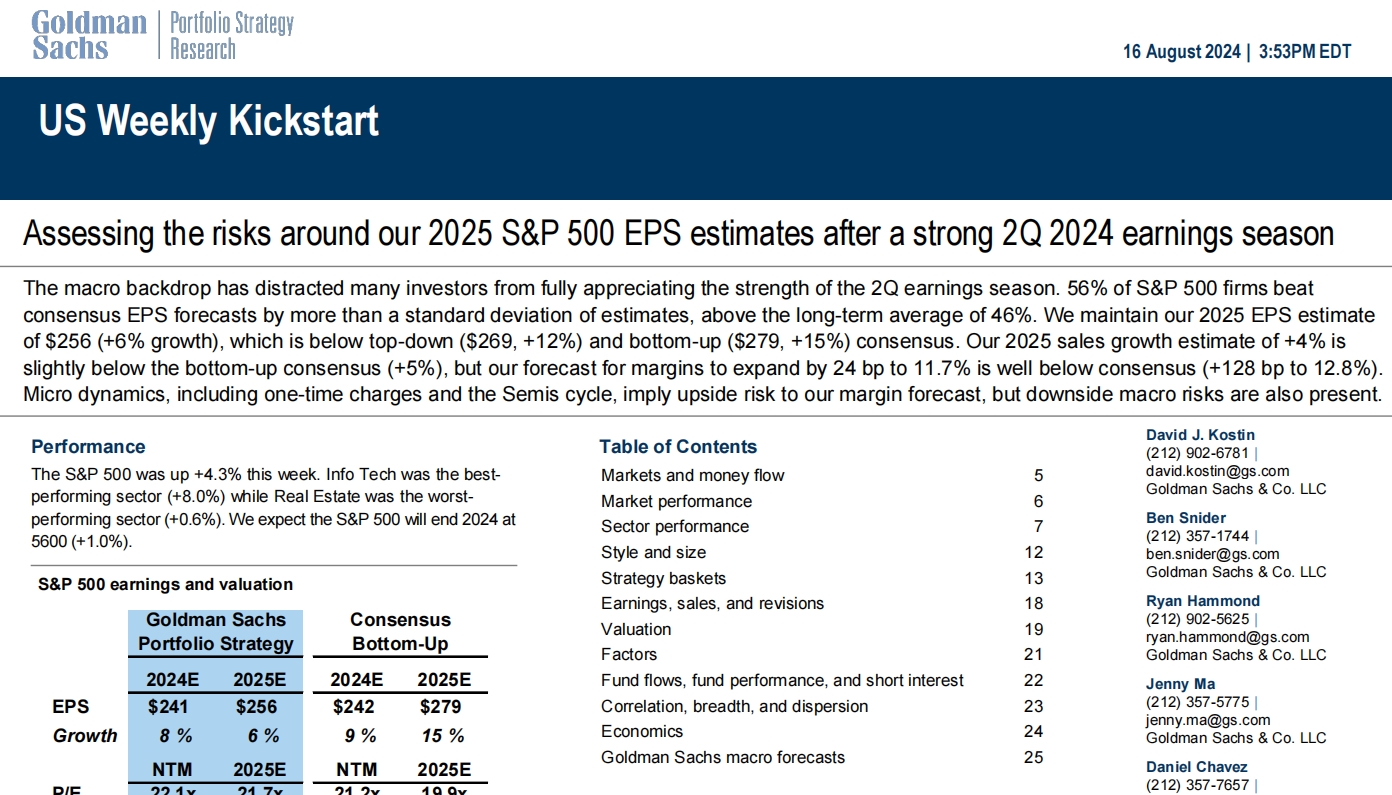

Assessing the risks around our 2025 S&P 500 EPS estimates after a strong 2Q 2024 earnings season

The macro backdrop has distracted many investors from fully appreciating the strength of the 2Q earnings season. 56% of S&P 500 firms beat

海外研报

2024年08月19日

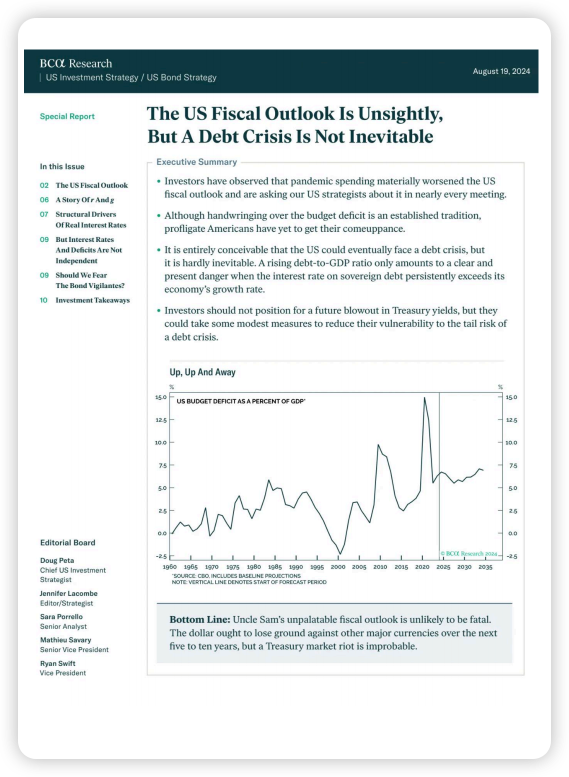

The US Fiscal OutlookIs Unsightly,But A Debt Crisis Is Not Inevitable

Executive SummaryInvestors have observed that pandemic spending materially worsened the USfiscal outlook and are asking our US strategists about it in nearly every meeting

海外研报

2024年08月20日

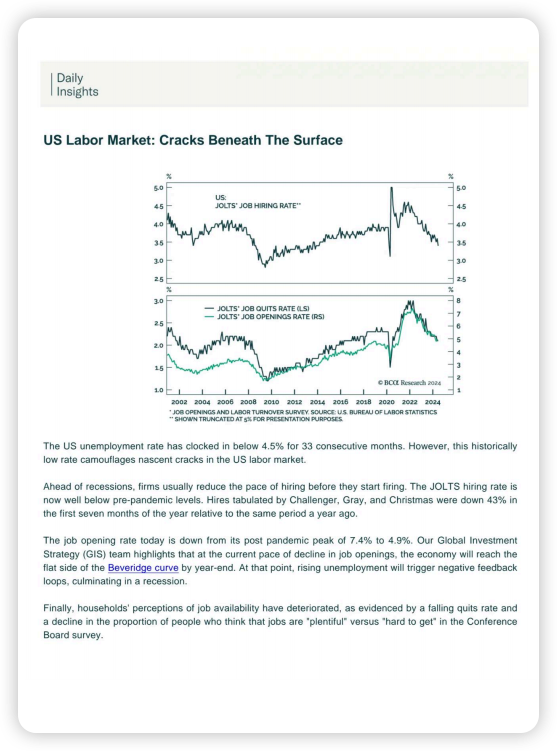

US Labor Market: Cracks Beneath The Surface

The US unemployment rate has clocked in below 4.5% for 33 consecutive months. However, this historicallylow rate camouflages nascent cracks in the US labor market.

海外研报

2024年08月20日

Q2 preview: bumpier path, same compelling destination

Blackwell transition could mute upside near-termMaintain Buy, top sector pick ahead of NVDA FQ2 (Jul) results due 28-Aug. Media reports

海外研报

2024年08月20日

Regime Indicator weakened, Recovery in question

Regime Indicator slips. Downturn next?Our US Regime Indicator declined in July for the first time since December 2023,

海外研报

2024年08月20日