海外研报

筛选

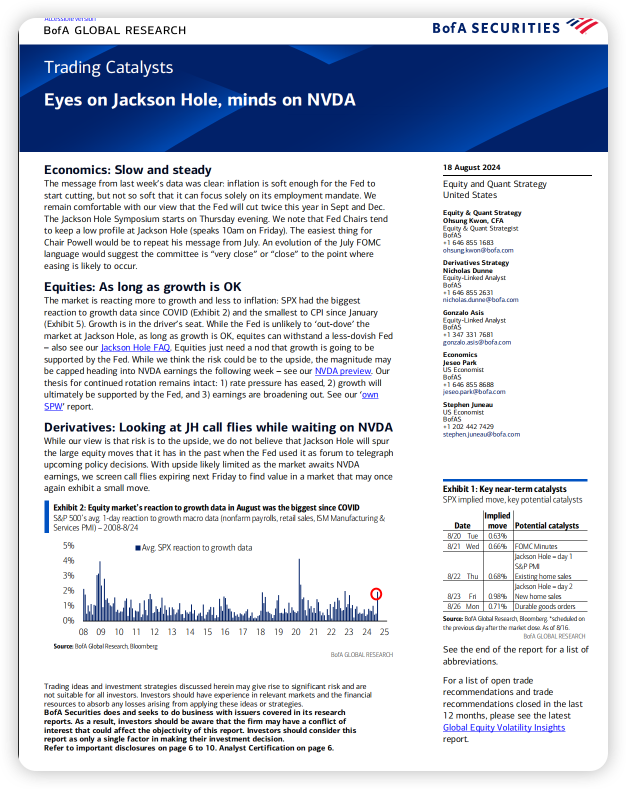

Trading Catalysts Eyes on Jackson Hole, minds on NVDA

Economics: Slow and steadyThe message from last week’s data was clear: inflation is soft enough for the Fed to

海外研报

2024年08月20日

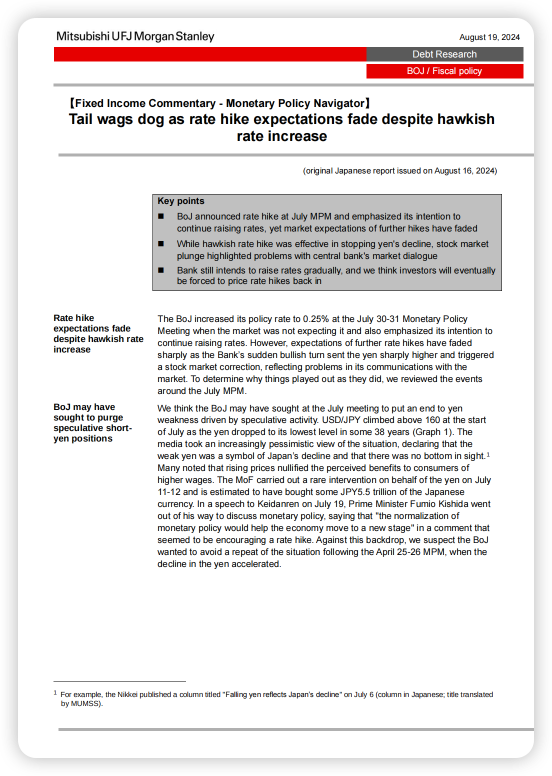

Tail wags dog as rate hike expectations fade despite hawkish rate increase

The BoJ increased its policy rate to 0.25% at the July 30-31 Monetary Policy Meeting when the market was not expecting it and also emphasized its intention to

海外研报

2024年08月20日

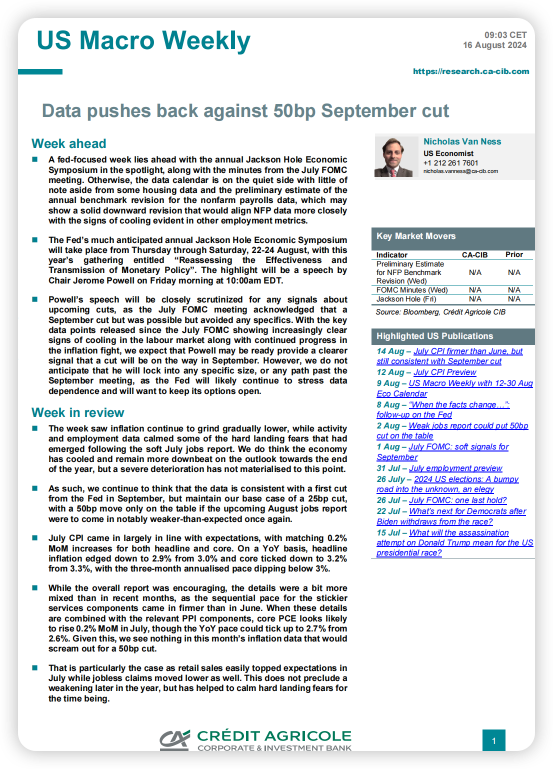

Data pushes back against 50bp September cut

A fed-focused week lies ahead with the annual Jackson Hole Economic Symposium in the spotlight, along with the minutes from the July FOMC

海外研报

2024年08月20日

Confidence Game-Global Daily

As we approach the Jackson Hole Symposium later this week the message from Fed speakers, broadly, has been that they are gaining confidence that the economy is reaching the point where

海外研报

2024年08月20日

Market expectations of the Fed's labormarket reaction

Today's chart explores how these changes as well as other dynamics over recentyears may have affected market expectations of the FOMC's reaction to the labormarket, drawing onaspecialquestiontheNYFed periodicallyincludesin

海外研报

2024年08月20日

The Major bond letter Free to View Fixed Income - Rates Global #52. Turning points

Head fake or the real thing? The question bond investors and traders are debating today is whether the events of the last few weeks will mark a decisive turning point

海外研报

2024年08月20日

Israel: Large Downside Surprise to Growth in Q2

Bottom Line: Israel’s GDP growth fell from +17.3%qoq annl. to +1.2%qoq annl.(both seasonally adjusted), which was significantly below consensus expectations

海外研报

2024年08月20日

Reiterate Buy rating (on Conviction List) on Potential for Positive EPS Revisions and Compelling

We reiterate our Buy rating on NVDA (also on the Conviction List)ahead of FY2Q (July) results scheduled for August 28 (post market

海外研报

2024年08月20日

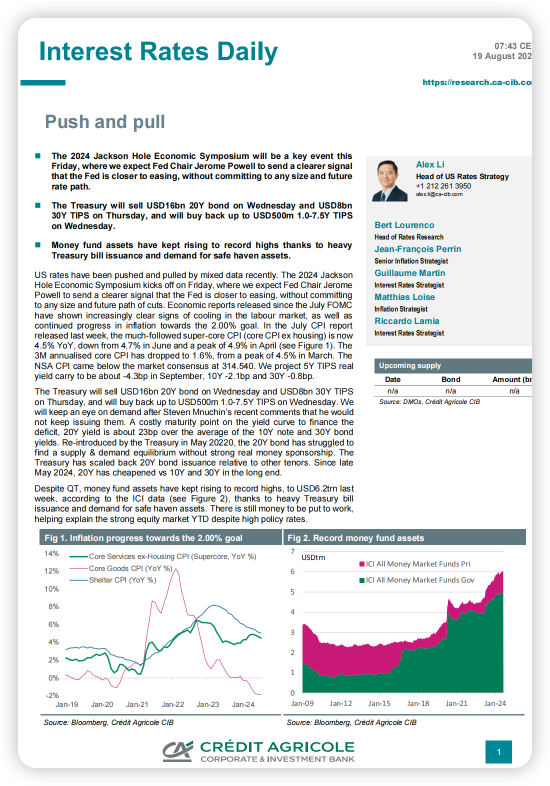

Interest Rates Daily-Push and pull

US rates have been pushed and pulled by mixed data recently. The 2024 Jackson Hole Economic Symposium kicks off on Friday, where we expect Fed Chair Jerome

海外研报

2024年08月20日

Multi-Asset Strategy Daily

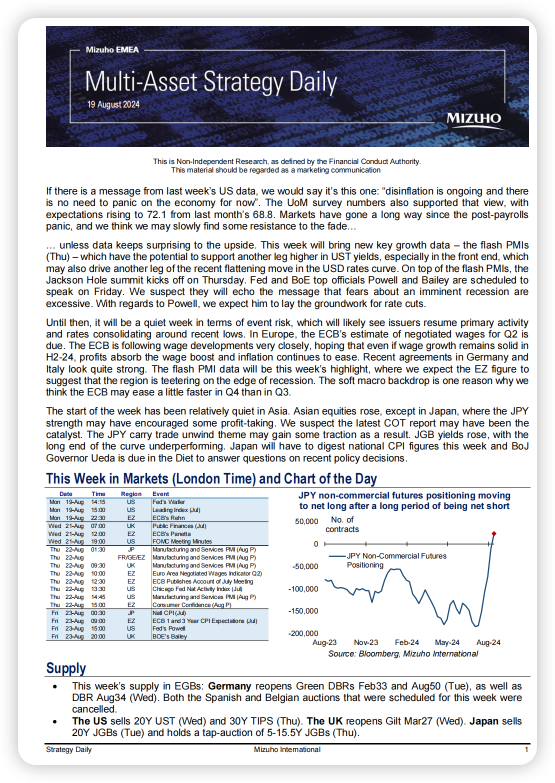

If there is a message from last week’s US data, we would say it’s this one: “disinflation is ongoing and there is no need to panic on the economy for now”. The UoM survey numbers also supported that view, with

海外研报

2024年08月20日