海外研报

筛选

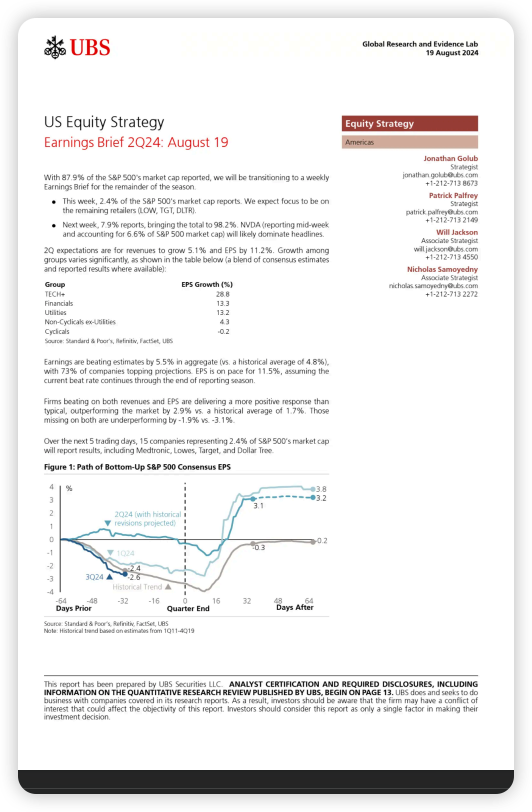

Us Equity StrategyEarnings Brief 2Q24: August 19

With 87.9% of the S&P 500's market cap reported, we will be transitioning to a weeklyEarnings Brief for the remainder of the season..

海外研报

2024年08月20日

Is the VlX spike a signal of wider credit spreadsahead?

A key debate last week was whether equities were sending a signal for creditThe massive spikes in cross-asset volatility in early August (e.g., 2, 4, 5 sigma moves in1Oyr USTs, IPYUSD, and VlX) have left investors actively

海外研报

2024年08月20日

Global Rates StrategySep/Dec Futures roll

Repo risk is meaningful for DecGiven the uncertain path of the Fed over the next few months, valuation of the Deccontracts will be sensitive to

海外研报

2024年08月20日

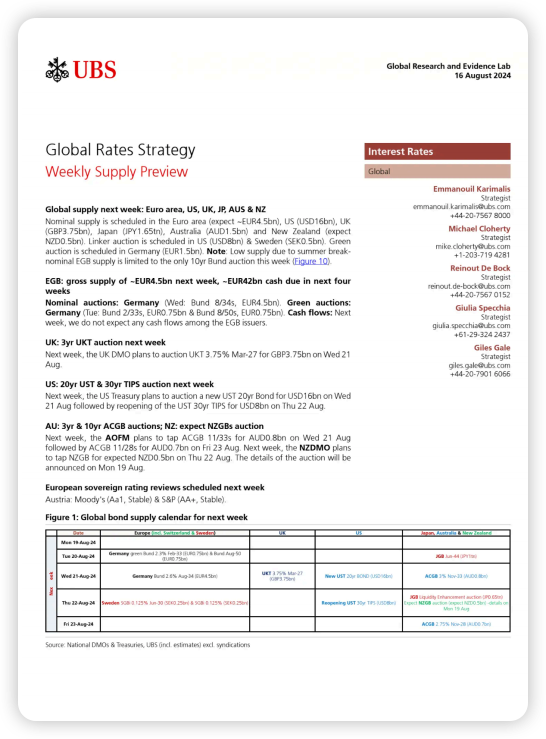

Global Rates StrategyWeekly supply Preview

Global supply next week: Euro area, Us, UK, JP, AUS & NZNominal supply is scheduled in the Euro area (expect ~EUR4.5bn), US (USD16bn), UK(GBP3.75bn), Japan (JPY1.65tn),Australia (AUD1.5bn) and New Zealand

海外研报

2024年08月20日

FAST FX Fair Value Model--USD looking undervalued

The FAST FX model continues to sit out the FX markets and remains up 2.50% over the past year with a hit rate of 50%. Heading into the Jackson

海外研报

2024年08月20日

USD: in the shadow of the Rockies

It was a tentative start to the week for risk sentiment. The rhetoric from the Fed remains mixed. While dovish FOMC voter Mary Daly expressed more confidence

海外研报

2024年08月20日

FIRST ECB MIDSUMMER DATA CHECK: CUT

Sticking to “data dependence” ahead of the September decision, at the last press conferenceChristine Lagarde said the ECB will focus especially on “WPP” – Wages, Productivity and Profits

海外研报

2024年08月21日

Macro Insights Weekly Putting the inflation genie back in the 2% bottle

The market is watching closely for signs for US economic slowdown, pricing in about 100bps in

海外研报

2024年08月21日

Breaking with convention--Global Daily

Pity those having to make forecasts for the global economy right now. After all, they are having to do so less than 80 days from a US election in which two radically different policy platforms are

海外研报

2024年08月21日

Americas Transportation: Eye on Freight: “Big Three” Ports Grow Above Seasonality

Imports were positive YoY in July, up 43%, after June’s strong 20% growth andMay’s -3% growth. July’s values of 1,016,497 TEUs was above prior implied values of

海外研报

2024年08月21日