海外研报

筛选

Cheney Reaction Global Daily

Friday’s US payrolls report was supposed to settle the question of whether the Fed would be cutting by 25bps next week, or 50. On Thursday of last week the OIS futures had 33.8bps of cuts

海外研报

2024年09月11日

GS--Brazil: Copom—Time to Walk-the-Walk and Hike, But Despacito (Ramos)

We expect the Copom to validate a moderate relatively short rate hiking cycle,starting with a 25bp hike at the September 18 meeting. In our assessment rate

海外研报

2024年09月11日

BofA --Securities Equity Client Flow Trends

Single stocks > ETFs:Last week, during which the S&P 500 was -4.2% (worst week since Mar‘23), BofA Securities clients were net buyers of US equities

海外研报

2024年09月11日

BNP--INVESTORS SET TO INCREASE HEDGE FUND EQUITY BETS BY YEAR-END

Equity remains by far the most popular strategy, with 61% of investors planning to allocate to it in H2 2024. This is followed by

海外研报

2024年09月11日

GS--AT&T Inc. (T): Communacopia + Technology Conference 2024 — Key Takeaways

Bottom line: We have three key takeaways: (1) Management continues to expect anormalization in the wireless industry, but has not seen this occur. The company

海外研报

2024年09月11日

MS--Morgan Stanley Global Macro Forum

= Analysts employed by non-U.S. affiliates are not registered withFINRA, may not be associated persons of the member and may not be

海外研报

2024年09月10日

JPM_US Market Intell Afternoon Briefing

US: Stocks rebounded from last week's selloff, There was no particular catalyst behind today'srally given the relatively quiet macro calendar. The recovery today was fairly broad-based: 83% ofthe SPX stocks closed in the green with all 11 sectors

海外研报

2024年09月10日

JPM_Japan_Equity_Strateg

Following the release of US employment data September 6, the yen strengthened to the ¥142/$ level and Nikkei 225 futures fell more than 3% over the weekend. Japanese

海外研报

2024年09月10日

JPM_Flows & Liquidity What do markets expect ahead of the US jobs report

Market pricing appears to suggest little US recession risk priced in equities and credit while bond and commodity markets seem to price in

海外研报

2024年09月10日

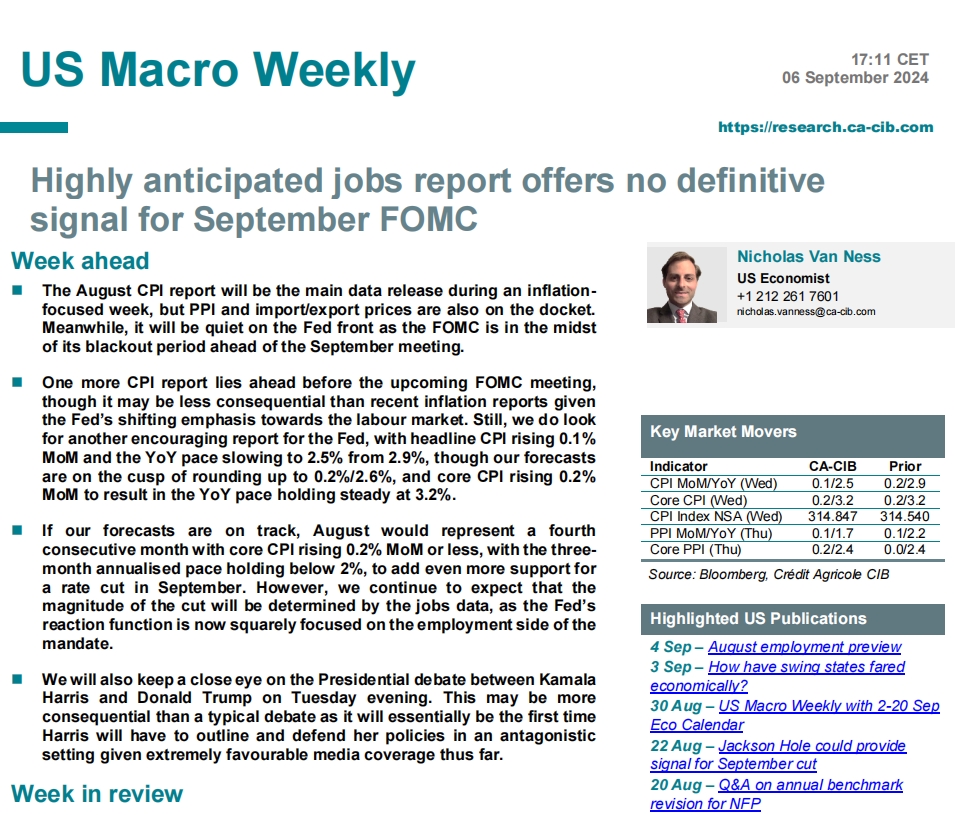

US--Highly anticipated jobs report offers no definitive signal for September FOMC

The August CPI report will be the main data release during an inflationfocused week, but PPI and import/export prices are also on the docket.

海外研报

2024年09月10日